Introduction

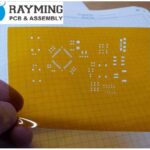

A printed circuit board (PCB) is an essential component of most modern electronic devices. It provides the mechanical structure to mount the electronic components and the electrical connections between components. Determining the largest PCB manufacturer provides insight into the country leading in electronics production and manufacturing capabilities. This article will analyze the global PCB production distribution and identify the top PCB manufacturing countries.

Global PCB Production Share

According to data from Prismark, the global PCB production in 2021 was estimated to be $73.5 billion. The distribution of production value by region was:

| Region | Production Value | Market Share |

|---|---|---|

| China | $35.1 billion | 47.7% |

| Rest of Asia | $14.9 billion | 20.3% |

| Americas | $9.5 billion | 12.9% |

| Europe | $8.8 billion | 12.0% |

| Japan | $5.2 billion | 7.1% |

As seen above, China has the dominant market share of 47.7% of global PCB production value. This is nearly half of the world’s PCB manufacturing.

The Rest of Asia region (excluding China and Japan) accounts for 20.3% of production. This includes major manufacturing countries like Taiwan, South Korea, and Southeast Asia.

Top 5 PCB Manufacturing Countries

Based on the production value data, the top 5 PCB manufacturing countries in 2021 were:

- China – $35.1 billion

- Taiwan – $8.6 billion

- South Korea – $6.3 billion

- Japan – $5.2 billion

- USA – $3.8 billion

Here are some details on the top 3 countries:

1. China

- Accounts for 47.7% of global PCB production, nearly half of total production

- Home to over 5000 PCB manufacturers

- Major hubs located in Guangdong, Jiangsu, Zhejiang provinces

- Key players include Shennan Circuits, Kinwong, Wuzhu Technology

2. Taiwan

- Second largest producer with 11.7% global market share

- Strong at producing high-mix, low-volume complex PCBs

- Major companies include Unimicron, Zhen Ding Tech, Tripod Technology

3. South Korea

- Accounts for 8.6% of global production

- Focus on HDI (high density interconnect) PCBs

- Leading companies are Samsung Electro-Mechanics and LG Innotek

PCB Production Trends

The PCB manufacturing landscape has seen some key trends emerge:

- Consolidation – Industry consolidation as small/mid-size companies are acquired by larger manufacturers. For example, Shennan Circuits in China acquired 17 companies between 2015-2020. This leads to increased concentration of production in major players.

- High-end PCB focus – Although China leads in volume, Taiwan and Korea have expertise in producing advanced, high-mix, low-volume PCBs used in defense, aerospace, auto electronics etc. There is also a push by China into these high-end PCB segments.

- Smart factory automation – Manufacturers are adopting more automation and smart factory solutions driven by Industry 4.0 advancements. This increases productivity and improves quality control.

Challenges Facing the PCB Industry

Some challenges face PCB production globally:

- Environmental regulations – Tighter environmental regulations have increased costs associated with PCB manufacturing chemicals, waste treatment, emissions control etc. This has led some production to shift out of China.

- Raw material costs – Key raw materials like copper foil and glass fabric have seen large price fluctuations driven by market dynamics and supply chain issues. Managing these input costs is a challenge.

- Geopolitical risks – Trade conflicts and geopolitical issues pose risks to supply chains. For instance, US-China trade tensions have impacted the PCB supply chain. Companies have adopted strategies like localization to mitigate such risks

Future Outlook

The global PCB market is forecast to grow steadily at a CAGR of around 3% from 2022-2027, driven by demand across sectors like auto, industrial, telecom etc. China will likely maintain its lead in manufacturing output although its market share may moderately decline as production rises in other Asian regions. The industry will continue to see consolidation and innovations in smart manufacturing.

Conclusion

In summary, China is unambiguously the largest PCB producing country, accounting for almost half of global PCB production value. While China dominates in volume output, Taiwan and South Korea are leaders in advanced PCB manufacturing. The industry is adapting to changes through consolidation, automation and supply chain strategies. China is expected to preserve its number one position although its share may gradually reduce as other Asian countries expand production capabilities.

Frequently Asked Questions

Q1. Which Chinese province produces the most PCBs?

The Guangdong province in southern China is the largest PCB producing area in China and globally. The Pearl River Delta region of Guangdong has a massive electronics manufacturing base and is home to thousands of PCB companies. Guangdong accounts for about 50% of the total PCB production in China.

Q2. What are some key factors that contributed to China’s dominance in PCB manufacturing?

Some key factors for China’s PCB industry success include:

- Low labor costs – Extensive electronics workforce willing to work for lower wages compared to other countries. This reduced labor costs significantly.

- Economies of scale – As production volumes expanded massively, Chinese manufacturers benefited from economies of scale and dropping unit costs.

- Ecosystem – A vast electronics supply chain and industry cluster surrounding PCB production lowered logistics costs.

- Support – Government support including subsidies and policies that favored local PCB manufacturing.

- Technology acquisition – Successful acquisition of technology and know-how through foreign partnerships and acquisitions.

Q3. Is PCB manufacturing shifting out of China? Where is production moving to?

There has been some shift of lower-end PCB production out of China to Southeast Asia for cost advantages as wages rise in China. Countries like Vietnam, Thailand, Philippines and Indonesia have attracted PCB factories. Additionally, some production has moved to Mexico to supply the US market faster. However, China remains dominant in PCB output by a large margin. Advanced PCB capabilities are increasing outside China in Taiwan, Korea and Japan.

Q4. Which US companies are leading PCB manufacturers?

The major PCB manufacturers in the US include:

- TTM Technologies

- Sanmina Corporation

- Flex Ltd.

- AT&S

- Kimball Electronics

The US accounts for about 5% of global PCB production, behind the Asian countries. Top American PCB companies focus on high-mix, quick-turn PCBs.

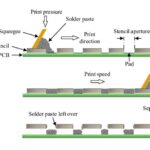

Q5. How has automation impacted PCB manufacturing capabilities?

Automation and smart manufacturing have enabled PCB producers to:

- Optimize factory floor operations and machine utilization through data collection and analytics.

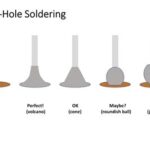

- Implement advanced industrial robots for repetitive processes like soldering.

- Leverage 3D printing for rapid prototyping.

- Utilize AI for process control and quality assurance during PCB fabrication.

- Adopt digital twin technology for virtual modeling of PCB production.

These Industry 4.0 technologies have enhanced quality, increased productivity, and enabled mass customization.

Leave a Reply