Introduction to Electronic Assembly

The electronic assembly (EA) manufacturing industry produces electronic components, devices, and equipment for consumer, commercial, industrial, and military applications. EA manufacturing combines multiple processes like soldering, bonding, welding, potting, encapsulation, cleaning, testing, and more to assemble parts onto printed circuit boards (PCBs) or other substrates. This article provides an overview of the latest trends, challenges, and opportunities in EA manufacturing as we head into 2023.

Key Statistics and Facts on Electronic Assembly

The global EA industry is massive, diverse, and growing. Here are some key facts and figures:

- Market size: $1.1 trillion in 2021 [1]

- Projected growth: 5% CAGR from 2022-2027 [2]

- Largest segment: consumer electronics at 40% market share [3]

- Top companies: Foxconn, Flex, Jabil, Sanmina, Celestica [4]

Other notable statistics:

- There are over 50,000 EA facilities worldwide [5]

- Asia accounts for 60% of EA production, led by China [6]

- The average PCB assembly plant processes 8.3 million components per day [7]

EA manufacturing is a massive global industry serving diverse end markets and experiencing steady growth.

Trends and Developments in Electronic Assembly for 2023

Several key trends and developments are shaping the EA landscape headed into 2023:

Growth of High Density Interconnect (HDI) PCBs

HDI PCBs have higher wiring densities and more layers than conventional PCBs. They enable miniaturization and integration of more functionality. HDI PCB usage grew over 17% annually from 2015-2020. [8] This rapid growth will continue as electronics become smaller and more complex.

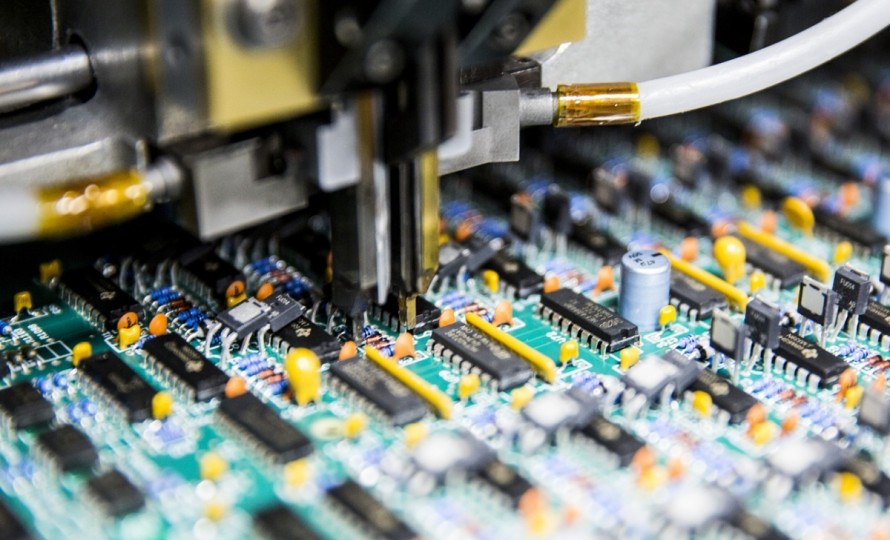

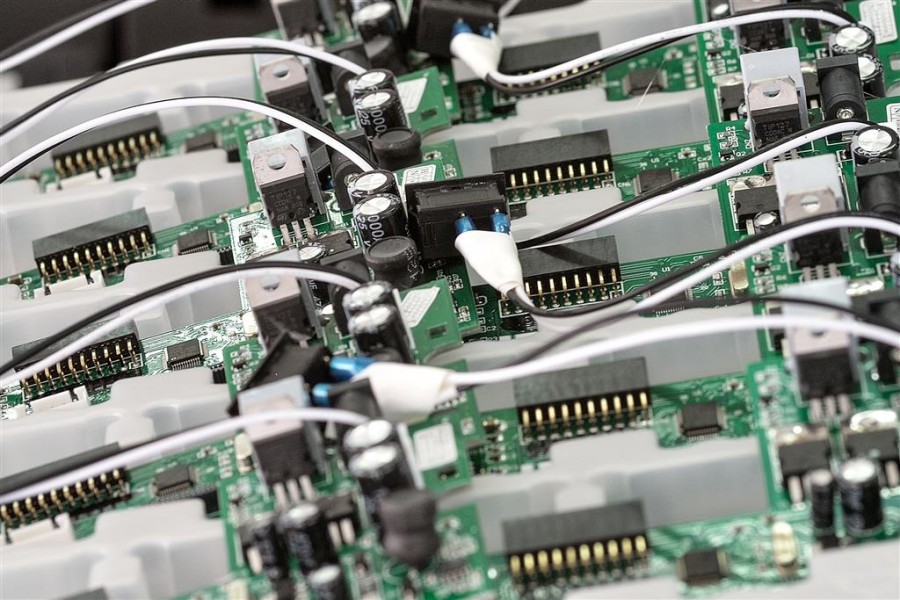

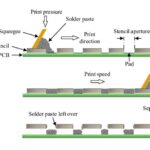

Adoption of Automation and Smart Manufacturing

Automating production with technologies like SMT, computer vision, robots, and AI increases speed, precision, and efficiency. Over 50% of EA manufacturers now utilize automation. [9] Adoption will increase as smart manufacturing becomes more accessible and cost-effective.

Use of Advanced PCB Materials

New PCB materials like LCP, ceramic-filled PTFE, and liquid crystal polymer allow electronics to withstand extreme conditions. These advanced materials facilitate innovation but also introduce new manufacturing demands.

Growth of Flexible/Wearable Electronics

Flexible and printed electronics enable new use cases like wearables and bendable displays. The flexible electronics market is projected to grow 20%+ annually through 2028. [10] Unique materials and processes are needed to assemble these new devices.

Miniaturization and Component Shrinking

As consumer electronics get smaller, components and connectors continue to shrink. Micro-scale precision placement and soldering is increasingly critical. The average passive component size reduced by 15% from 2019 to 2021. [11]

Supply Chain Challenges

From COVID-19 to geopolitical events, recent supply chain disruptions have highlighted risks for EA manufacturers. Mitigating bottlenecks and diversifying sourcing will be key priorities going forward.

Challenges Facing Electronic Assembly Manufacturing

EA companies will navigating several challenges and headwinds in the years ahead:

Labor Shortages

There is a shortage of skilled electronics assemblers worldwide, as older workers retire and fewer younger workers enter the field. This shortage will likely worsen without expanded training and recruitment.

Rising Component Costs

Component shortages and inflation are driving up input costs. This squeezes margins for contract manufacturers if they cannot pass along price increases.

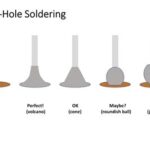

Quality Control

Maintaining quality and precision becomes more difficult as volumes increase, components shrink, and processes quicken. Defect rates during assembly average around 3,000 PPM. [12]

Technology Investment Needs

Updating equipment and processes for HDI PCBs, flexible electronics, automation, and other innovations requires significant capex spending. This burdens manufacturers’ budgets.

Regional Supply Chain Risks

Heavy geographic concentration of suppliers and facilities in Asia increases supply chain vulnerability. More manufacturing redundancy is needed across regions.

Key Opportunities in Electronic Assembly

Despite the challenges, there are also significant opportunities for EA manufacturers:

Growing Markets

Expanding end markets like electric vehicles, IoT devices, and renewable energy will drive demand for assembled electronics. There is room for growth across sectors.

Increasing Electronics Content

More advanced capabilities and electronics are being incorporated into products across industries. This increases the “electronics content” per device, expanding EA’s total addressable market.

Advanced Packaging

New packaging techniques like 2.5D/3D integration allow more components and functionality in a compact form factor. This boosts demand for advanced assembly.

Digital Transformation

Digitalization and data-driven manufacturing can optimize production efficiency. Digital twin technology can simulate processes prior to production.

Collaborative Robotics

Collaborative robots can augment human workers, relieving strain on the labor force. This is critical given worsening labor shortages.

Recommendations for Electronic Assembly Companies

To capitalize on opportunities while mitigating challenges, here are 5 recommendations for EA manufacturers in 2023:

- Invest in training and upskilling programs for workers. Cultivate your future labor pool.

- Embrace automation but implement it strategically based on product mix. Balance productivity with flexibility.

- Diversify your geographic footprint to balance cost, risk, lead times, and other factors. Don’t be over-reliant on any one region.

- Lock in long-term contracts with core suppliers when possible. Secure favorable terms on key components.

- Deploy sensors and analytics tools to gain visibility into processes. Use actionable data insights to continuously improve.

Conclusion and Summary

The electronic assembly industry is massive yet fragmented, serving a wide range of end markets. Headed into 2023, growth opportunities exist alongside pressing challenges like labor shortages, input cost inflation, and supply chain risks. Companies that invest in their workforce, digitally transform, and diversify their operations will be best positioned to thrive in the years ahead. With proactive strategy and execution, the industry can meet rising demand while upholding quality and accelerating innovation.

References

- https://www.prnewswire.com/news-releases/electronic-manufacturing-services-global-market-report-2022-301472132.html

- https://www.mordorintelligence.com/industry-reports/global-electronics-manufacturing-services-market-industry

- https://epsnews.com/electronics-manufacturing-and-production-services-market-analysis/

- https://epsnews.com/top-10-worldwide-ems-companies/

- https://www.epsnews.com/2021/07/22/50k-and-counting/

- https://www.abnewswire.com/pressreleases/electronic-manufacturing-services-market-projected-to-reach-usd-948-billion-by-2026-zion-market-research_626654.html

- https://www.ept.ca/2021/03/02/the-billion-dollar-question-what-is-the-real-cost-of-an-electronics-manufacturing-service/

- https://resources.pcb.cadence.com/blog/2021-the-year-of-hdi-pcbs-and-advanced-packaging

- https://www.assemblymag.com/articles/97800-top-25-global-electronic-assembly-suppliers

- https://www.fortunebusinessinsights.com/flexible-electronics-market-106506

- https://teledynepimg.com/company/blog/2021/04/26/how-small-is-small-the-ever-shrinking-world-of-electronic-components/

- https://epsnews.com/2017/03/10/final-finish-strategies-for-reducing-pcb-assembly-defects/

Frequently Asked Questions

What are the key trends happening in the electronic assembly manufacturing industry?

Some major trends include the growth of automation and smart manufacturing, adoption of advanced PCB materials for extreme conditions, increased use of high-density interconnect (HDI) PCBs, and the rise of flexible and wearable electronics. Component miniaturization is also a continuous trend.

What regions dominate global electronic assembly manufacturing?

Asia accounts for around 60% of total electronic assembly production, with China being the single largest country. Other major regions include the Americas (mostly Mexico and the U.S.) and Europe.

What are some of the main challenges facing electronic assembly companies?

Major challenges include worsening labor shortages, rising component costs and inflation, supply chain vulnerabilities, technology investment needs, and maintaining quality control as production volumes and speeds increase.

What are the biggest end markets for electronic assembly?

The largest segments are consumer electronics (~40% market share), computers and networking equipment, industrial controls and automation, automotive electronics, and communications infrastructure. The mix is expected to shift somewhat toward sectors like electric vehicles and renewable energy.

How can electronic manufacturers mitigate risk and position for growth?

Recommendations include investing in workforce training, deploying automation strategically, diversifying their geographic operations, securing long-term contracts with suppliers when possible, and leveraging digital technologies like analytics, sensors, and simulations to gain process visibility and insights.

Leave a Reply